A confidential Russian government document obtained by Dallas from the Ministry of Economic Development reveals the stark reality behind Moscow’s economic projections through 2027, exposing a nation preparing for prolonged conflict while grappling with structural decline masked by wartime spending. The forecast, prepared for Russia’s government and defense establishment, projects steadily declining growth rates and remarkably static employment figures that suggest the Kremlin has no expectation of ending its war in Ukraine within the planning horizon. These official projections, combined with Russia’s increasingly secretive approach to economic data, paint a picture of an inflated war economy fundamentally distorted by military priorities and vulnerable to sustained Western pressure.

The Military-Industrial Life Support System

Since 2022, Russia’s so-called economic “growth” has largely been a massive defense contractor subsidy. The confidential forecast shows military-industrial output growing 12.4% annually through 2027, while civilian manufacturing stagnates at 1.3%. This shift explains why half of Russian coal firms lost money in 2024 despite GDP growth – resources are diverted to war production.

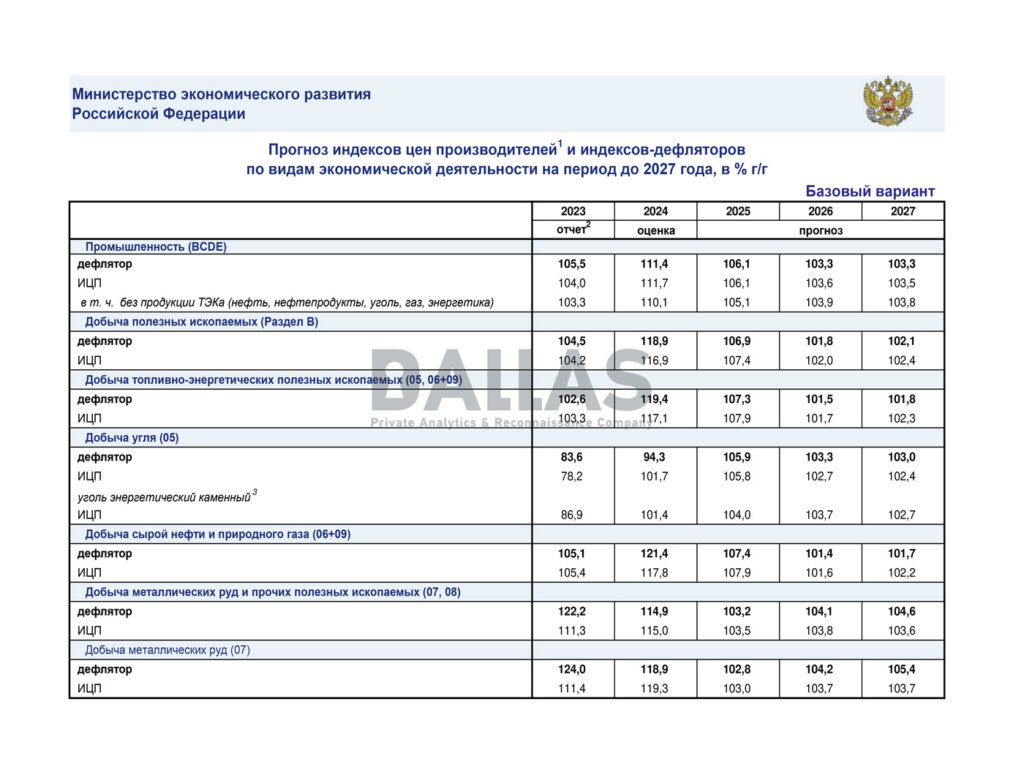

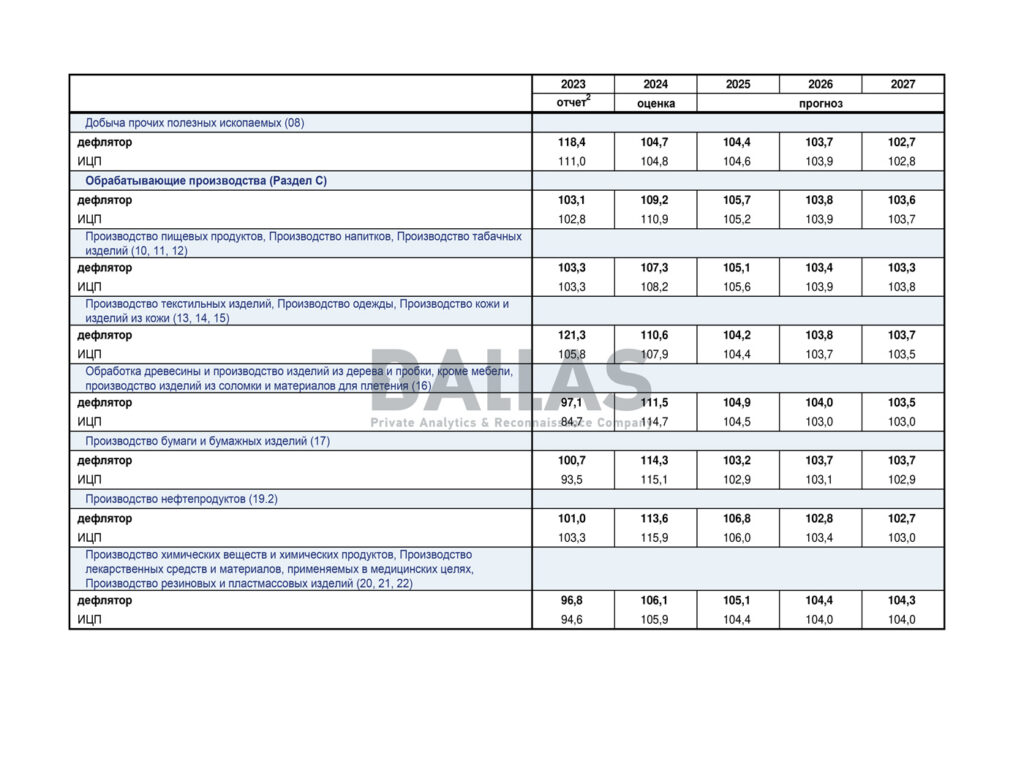

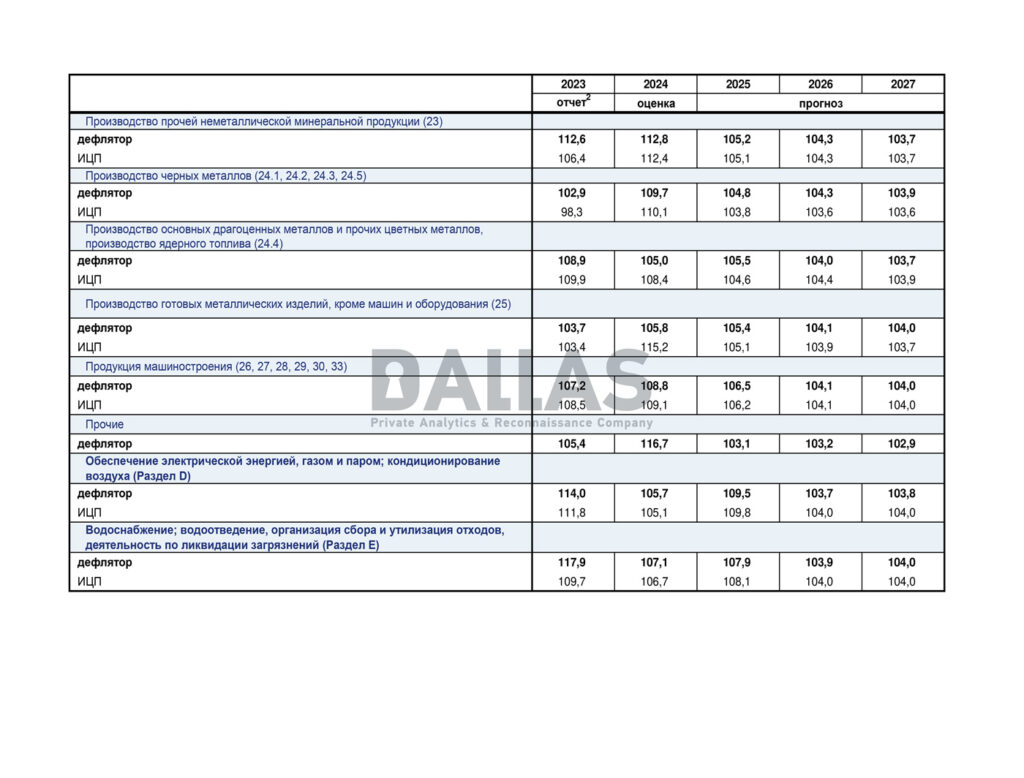

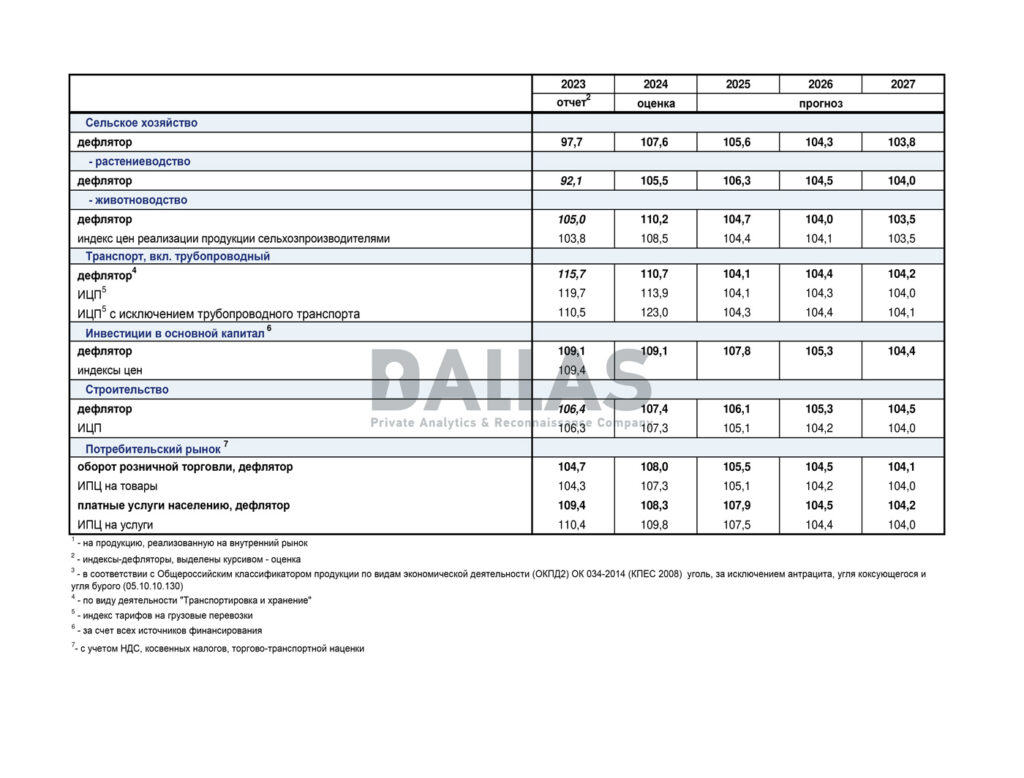

The Ministry’s projections confirm this unsustainable model:

- Defense spendingconsumes 8.9% of GDP by 2025, nearly triple NATO’s average

- Fixed capital investment growth plummets from 7.8% in 2024 to 2.1% in 2025 as civilian sectors starve

- Inflation persists at 5.8% through 2026 despite price controls, signaling structural overheating

The Fiscal Time Bomb

Beneath Russia’s veneer of fiscal stability lies a a miscalculation compounding its debt risks. Moscow expected the ruble to weaken, but it has instead strengthened 37% in 2025, shrinking energy revenues and deepening budget deficits. This unplanned currency surprise creates a fiscal double bind:

1. Energy Revenue Compression: With oil prices holding at $65-70/barrel, every dollar of hydrocarbon exports now converts to 19% fewer rubles than projected. At current rates (77.50 RUB/USD), $239 billion in forecasted 2024 energy revenues yield 18.5 trillion rubles – 4.1 trillion less than the 22.6 trillion rubles expected at 103.2 RUB/USD. This gap equates to 45% of Russia’s 2024 defense budget.

2. Sanctions Amplification Risk: Proposed U.S. measures targeting Arctic LNG exports and shadow tanker fleets threaten to compound revenue losses even more. A 20% reduction in energy export volumes at current RUB/USD rates would slash ruble revenues by 3.7 trillion annually – equivalent to 80% of Russia’s national healthcare budget.

With 64% of budget revenues tied to dollar/euro-denominated exports, the unexpected appreciation effectively imposes a hidden 9.2% austerity cut on federal spending power compared to original projections. This miscalculation forces Moscow to choose between deeper deficit spending or cuts to military production – a dilemma exacerbated by the ruble’s resilience being rooted in non-market measures rather than organic economic strength.

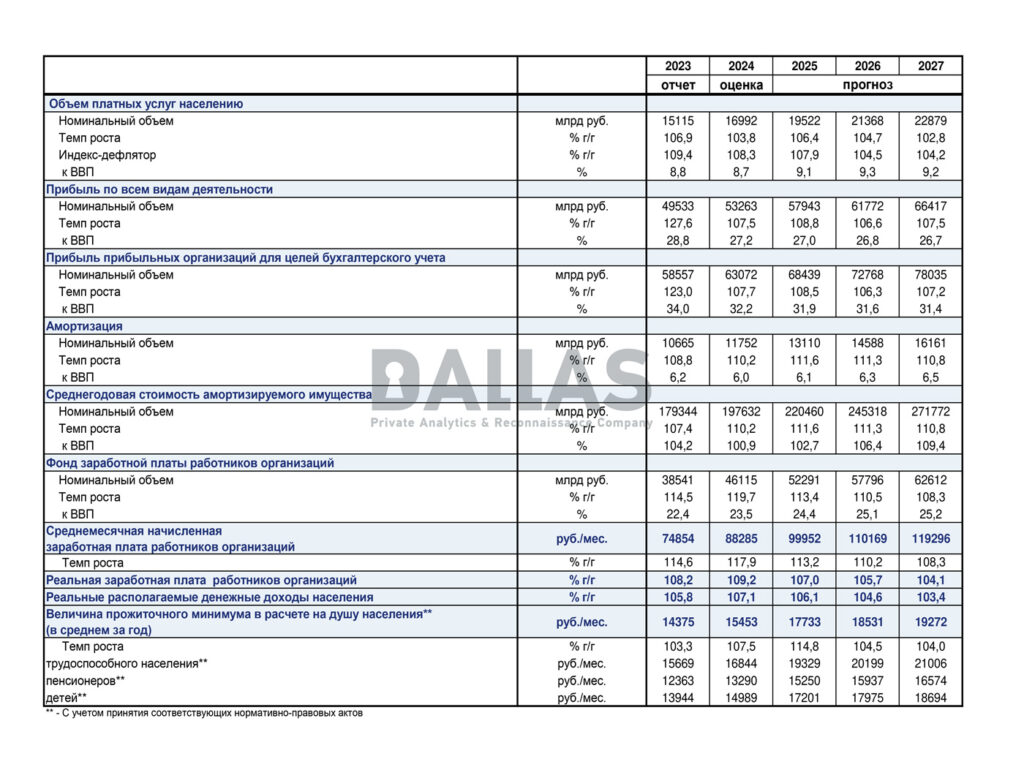

These fictions allow temporary fiscal balancing but intensify long-term risks. By 2025, debt servicing costs will consume 14% of budget expenditures, forcing cuts to healthcare and education already degraded by wartime austerity.

The Labor Market Mirage

Perhaps the clearest window into Moscow’s true expectations for the war lies in its labor-force projections. Despite nearly a million battlefield casualties, a crackdown on migrants from Central Asia and the steady exodus of skilled professionals, the forecast somehow pegs the Russian workforce at virtually the same level – rising a mere 0.4 million from 76.0 million in 2024 to 76.4 million by 2027.

Even more striking is the Ministry’s insistence that unemployment will hover stubbornly at exactly 2.0 million over the period from 2025 to 2027. That exactitude reads less like an honest projection than a finely tuned policy instrument not to anger Kremlin’s dictator. By stripping conscripts out of the jobless rolls and recategorizing pensioners as “employed,” Rosstat (State Statistics Service) is able to uphold the unemployment rate of 3.8 percent – even as manufacturing vacancies near 22 percent expose glaring labor shortages.

Energy Exports: A Diminishing Lifeline

Russia’s energy complex – the kleptocracy’s backbone – faces accelerating decay despite stable production volumes. The Ministry’s forecast shows:

- Oil export revenues stagnant at $239 billion annually despite projected output increases

- Natural gas prices falling 18% by 2027 due to lost European markets

- Energy’s share of tax revenue dropping from 34% to 28% as subsidies to domestic consumers grow

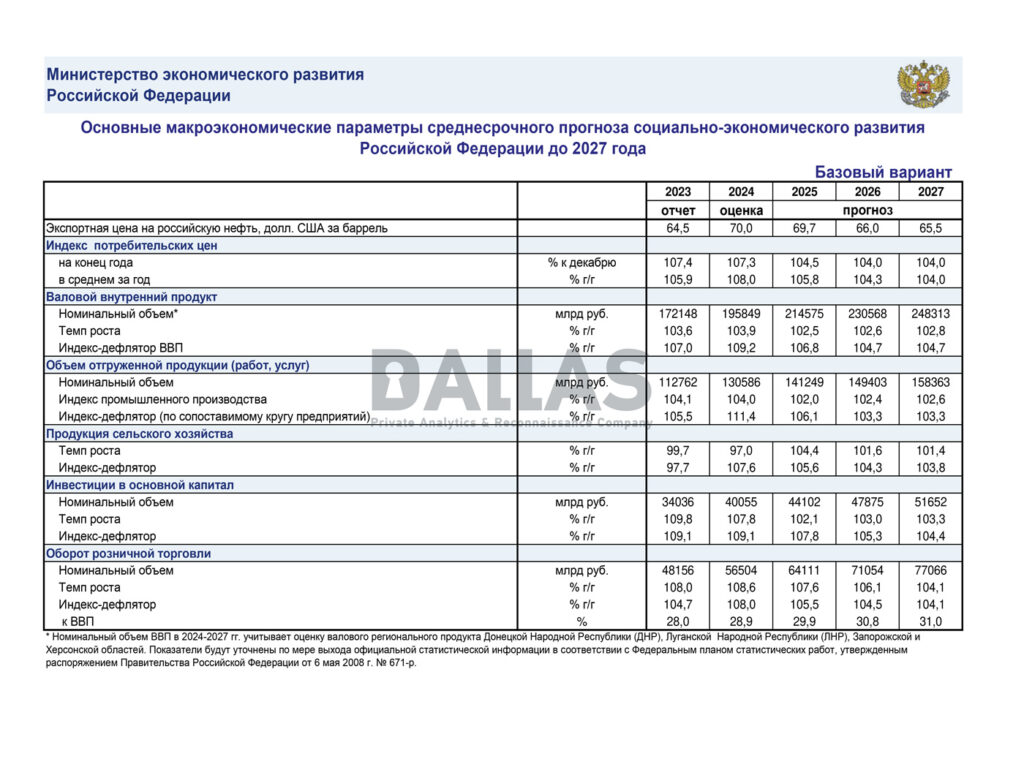

While oil and gas exports are expected to remain relatively stable in nominal terms – ranging from $229.7 billion to $239.7 billion annually – their share of GDP is projected to decline consistently from 11.2% in 2024 to 9.7% by 2027. This decline occurs not because of the broader economy’s expansion, but is driven by inflation running well above target levels.

The oil price assumptions underlying these projections – averaging $69.7 per barrel in 2025 and declining to $65.5 by 2027 – appear optimistic given potential further sanctions pressure. The forecast’s assumption of steady export prices fails to account for the growing momentum behind Western efforts to further restrict Russian energy revenues. The U.S. Senate’s proposed “Energy Sanctions Enforcement Act” targets Russia’s customers through secondary sanctions on LNG transshipments – a measure that could slash gas revenues by $12 billion annually. Simultaneously, Ukraine’s drone campaign against refineries has idled 14% of Russia’s oil processing capacity since May 2025, creating a $4 billion monthly export deficit, according to independent analysts.

The War Economy’s Diminishing Returns

Russia’s economic trajectory, as outlined in the Ministry of Economic Development’s medium-term forecast, reveals the unsustainable nature of its current war-driven growth model. The document projects real GDP growth declining from 3.9% in 2024 to just 2.5% in 2025, with only modest recovery to 2.8% by 2027. This deceleration occurs despite massive state spending on military production, indicating that the initial boost from defense expenditure is already beginning to fade.

The industrial production figures are particularly telling, showing a sharp drop from 4.0% growth in 2024 to just 2.0% in 2025, followed by gradual improvement to 2.6% by 2027. This pattern suggests that Russia’s manufacturing sector, heavily skewed toward military production, is struggling to maintain momentum beyond the initial wartime surge. Fixed capital investment, crucial for long-term economic health, shows an even more dramatic decline from 7.8% growth in 2024 to merely 2.1% in 2025, indicating that businesses are increasingly reluctant to invest in productive capacity amid economic uncertainty and sanctions pressure.

The retail trade turnover growth rate, a key indicator of consumer demand, is projected to fall from 8.6% in 2024 to 4.1% by 2027. This decline reflects the growing burden of military spending on household consumption and suggests that ordinary Russians are beginning to feel the economic strain of prolonged conflict. Real average wages are expected to decelerate from 9.2% growth in 2024 to 4.1% by 2027, further constraining domestic demand and highlighting the economy’s inability to sustain broad-based prosperity while funding a war against Ukraine.

Sanctions Vulnerability and Policy Implications

Russia’s economic facade, meticulously constructed through official data manipulation and military spending, remains brittle enough for targeted Western action to collapse. The Russian government’s own projections reveal significant vulnerabilities that the U.S. and the EU policymakers can exploit through sustained sanctions pressure.

The energy sector remains Russia’s primary vulnerability, accounting for over 10% of GDP throughout the forecast period despite projected declines. The government’s forecast of stable oil and gas export volumes makes these revenues an attractive target for additional sanctions, as any disruption would have immediate budgetary consequences. Accelerated sanctions enforcement could push oil revenues below $50 billion annually – the threshold where Moscow must choose between missiles and pensions.

Expanding semiconductor and other sanctions on crucial components to third-party suppliers could significantly slow down or paralyze Russian arms production.

The employment market’s artificial stability also presents opportunities for targeted pressure. Sanctions that force Russia to choose between military mobilization and economic production could strain the careful balance reflected in the government’s labor force estimates. The economy already shows signs of overheating in sectors supporting military production while civilian industries struggle with labor shortages and investment constraints. Exposing employment myths through independent reporting could further destabilize Putin’s domestic stability narrative.

The alternative – accepting Russia’s tales about readiness to fight until the end and statistical theater to prove its might at face value – risks repeating the West’s missteps on sanctions pressure and weak enforcement. As the confidential document obtained by Dallas proves, Moscow expects the war to continue through at least 2027, despite all the rhetorical facade about negotiations and conflict settlement. Only strong economic pressure combined with Ukrainian military successes can alter this calculus before Russia’s managed decline becomes irreversible.